Broken Promise Number One: Remember MACRA?

by Louis J. Wilson, MD, FACG

Chair, Legislative & Public Policy Council

Wichita Falls Gastroenterology Associates

Wichita Falls, TX

Remember when Congress “fixed” the sustainable growth rate (SGR) formula and need for annual crises in Medicare reimbursement? De ja vu.

We know that a 3% Medicare reimbursement increase, which didn’t even cover the inflation of maintaining medical practices, is set to expire at the end of 2022. Yet, physicians are currently facing an additional proposed 4.4% reduction to the physician fee schedule conversion factor (CF) for 2023, as well as more cuts beginning in January 2023, due to effect of Sequestration and PAYGO requirements. These cuts are anti-physician practice and threaten patient access to care. The Medicare physician fee schedule is clearly broken and needs both short-term and long-term corrections.

PQRS, MACRA and MIPS – Moving Goal Posts with Burdensome Effects

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) repealed the Medicare sustainable growth rate (SGR) formula and created a new reimbursement system – the Quality Payment Program (QPP) – beginning in 2017. When MACRA was passed, it was hailed as the elimination of SGR and as a way for Medicare providers to receive substantial bonuses for meeting quality reporting thresholds. The SGR hampered GI practices each year with an annual and accumulative Medicare payment cuts. Meaning, each time these cuts were averted, the bill was tacked on the following year creating payment cliffs. Congress finally put a stop to this madness and repealed the SGR formula and created two tracked of Medicare physician fee schedule reimbursement: the Merit-based Improvement Payment System (MIPS) and the alternative payment model (APM) system. To encourage provider to join an APM, Congress provided for higher annual updates than participating in the traditional fee for services Medicare and MIPS.

PQRS, MACRA and MIPS – Moving Goal Posts with Burdensome Effects

MIPS consolidated the legacy Medicare quality reporting programs: PQRS, the Value Modifier and the “Meaningful Use” program into one composite program. MIPS is broken down into 4 performance categories, with different weights for each category.

Providers receive a composite score (total performance score) from each performance category, on a scoring scale of 0 to 100. This score is compared to a “target score” based upon previous years’ actual composite score data and other data. The provider’s reimbursement is then “adjusted” (bonus, cut, or no update) on a sliding-scale based on a comparison of all other providers’ scores (Don’t forget the 2-year lag between each reporting year and the year of payment adjustments).

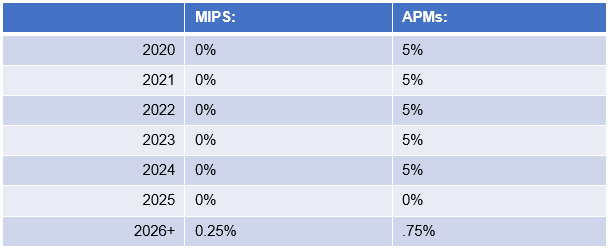

The provider still submits Medicare fee-for-service claims but reports other information as well. MACRA also provided for annual updates. Here is how they actually happened:

Source: The Medicare Access and CHIP Reauthorization Act (PL 114-10)

These updates are subject to our MIPS’s scores (cut, neutral payment, bonus) and APM targets.

If you recall, failing to meet MIPS performance threshold results in cuts. For example, the CY 2022 threshold is 75 points. This means that you must score at least 75 points in your 2022 reporting year to avoid a payment cut in CY 2024. There is a maximum cut of 9% for failing to successfully meet these performance thresholds.

Clinicians who achieved a final score of 89 or higher may have been eligible for the “exceptional performance adjustment,” funded from a pool of $500 million.

The physician community supported this, as it was hailed as a way to reward providers for meeting these performance thresholds. We also were told that the bonuses could be up the 3x the maximum cuts for that year. Thus, depending on where a provider score, that provider should be in line for a 9-27% bonus. In developing this bonus system, MACRA also did away with using the Medicare Economic Index (MEI) in annual physician reimbursement updates. I discuss this is in a previous blogpost.

Lesson Learned: The Promised Payment Updates Are a Mirage

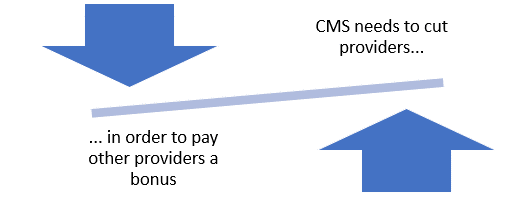

MACRA has always been subject to budget neutrality. Bonuses are to be proportional to cuts. The total amount paid out must be equal to the total amount of penalties assessed for budget neutrality that year, IN ORDER FOR THE POOL OF BONUS MONEY TO EXIST, THERE MUST FIRST BE CUTS. Sound familiar? I discussed why the budget-neutrality system is broken in a previous blogpost. In order to get MACRA passed, Congress was forced to double-down on a budget-neutral payment system!

As mentioned above, Congress encouraged providers to join the APM track by providing a 5% bonus. The APM are subject to financial risks and benefits for meeting thresholds and goals. CMS provides the goals and targets and the APM entity must meet the targets. The APM entity decides how the bonuses (if any) are divided up among the APM physicians. While the outcomes of the APM models are mixed, APM provider did receive this 5% bonus. This bonus ends in the 2024 payment year.

MIPS, however, is a very different story.

ACG Members Held Up Our End of the Bargain: What Did We Get in Return?

CMS provided performance data from 2019, which highlights this “budget neutrality” dilemma. According to CMS, there were roughly 1.1 million providers qualifying for MIPS in the 2017 reporting year, with roughly 1 million qualifying for a neutral or positive adjustment. Roughly 5% received a payment cut in CY 2019. Roughly 1 million providers who successfully participated in MIPS were left with a meager bonus in payment year 2019, or .2% – 1.88%.

Source: 2017 Quality Payment Program Reporting Experience Report

QPP Resource Library (cms.gov)The trend continued in 2020, where 2% of the 900,000 MIPS-eligible clinicians received a payment cut up to 5%, based on 2018 reporting year data. The bonuses in payment year 2020 were again insubstantial. A meager .2 – 1.68%. These data also include providers meeting the exceptional bonus threshold!

Source: 2018 Quality Payment Program Experience Report

It was the same story in 2022, where out of 933,545 MIPS eligible clinicians in performance year 2020, 915,994 (98.12%) avoid a MIPS payment cut (based on 2020 reporting year submissions). Almost 81% (752,396) achieved the exceptional performance threshold. We dealt the with burdens to earn bonuses ranging from 0.001% – 1.87%. There are 17,511 MIPS eligible clinicians (1.88%) receiving a negative payment adjustment in the 2022 payment year.

Source: 2020 Quality Payment Program Experience Report

Clearly, this MACRA bonus pool is a mirage, yet the physician community continues to jump headfirst into a pile of sand. We must change this.

What Else Did We Get? More Burdens

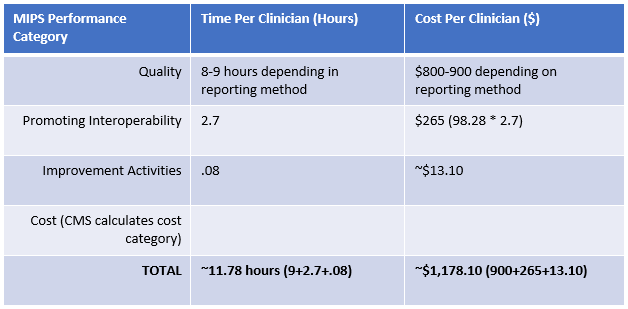

Each year, as part of the Medicare physician fee schedule policy changes CMS is required to include reporting “MIPS burden estimates”. In the recent 2023 Medicare physician fee schedule proposed rule, CMS estimate the following estimates for each MIPS performance category:

Source: CY 2023 CMS Medicare Physician Fee Schule Proposed Rule (CMS-1770-P)

Are These Estimates of Burden Accurate? No

How much has MIPS impacted your practice? A recent study published in JAMA suggests that these estimates are woefully low.

“In this qualitative study using interviews with leaders of 30 physician practices across the U.S., an average of $12,811 per physician was spent to participate in MIPS in 2019. Clinicians and administrators spent more than 200 hours per physician on MIPS-related activities.”

Alarm Bells Are Ringing. How Will ACG Respond?

Déjà vu. We are back to the old SGR days, but now with more burdens, higher inflation, higher practice costs, and more staffing challenges!

Solutions Must Come From Congress:

Under the Social Security Act, there is no administrative or judicial review of Medicare reimbursement changes. Only congress has the oversight, jurisdiction, and authority to make any changes. Therefore, long-term changes must be enacted by Congress. Real disruption is needed, starting with some rather obvious first steps:

- Eliminating budget neutrality adjustments.

- Require an annual update to the CF equal to the MEI.

- Ensure transparency and providing due process for providers who believe reimbursement does not accurately reflect costs associated with providing services.

Source: Medicare Reimbursement Statute- Social Security Act 1848(c)(2)(B)(ii)(II) and 1848(c)(2)(F)

A Call to Action:

We must fight these damaging cuts and demand permanent solutions. The ACG Legislative & Public Policy Council, the Board of Governors, and ACG National Affairs Action Network must remain active throughout the year, educating Congress on this issue, and will increase our efforts across the board. We also need more members, like you, to get involved. Click here to join! In the upcoming weeks, I will be providing regular updates on our meetings with Congress and ways you can get involved. We need to show Congress just how antiquated and broken this reimbursement is to us. We will do this not only for our medical practices, but for the patients and communities we serve.