Remember when Congress ‘fixed’ the sustainable growth rate (SGR) formula and annual crises in Medicare reimbursement? Déjà vu.

We know that a 3.36% Medicare reimbursement cut is looming in 2024. We also know that an additional 2% cut is scheduled for all Medicare providers (hospitals and providers), due to a congressional budgeting mechanism called sequestration. These cuts are anti-physician practice and threaten patient access to care.

Clearly, the Medicare physician fee schedule is broken and needs both short-term and long-term corrections.

Wait, Wasn’t MACRA Supposed to Fix This?

Yes.

Before the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), the Medicare sustainable growth rate (SGR) formula hampered GI practices. The annual and accumulative payment cuts meant that even when cuts were ‘averted’, they were effectively tacked on to the following year’s bill, creating payment cliffs.

When MACRA was passed, it replaced SGR with a new reimbursement system, the Quality Payment Program (QPP), beginning in 2017. This not only was hailed as the end of SGR, but also as a way for Medicare providers to receive substantial bonuses for meeting quality reporting thresholds.

Congress created two tracks of Medicare physician fee schedule reimbursement: the Merit-based Improvement Payment System (MIPS) and the alternative payment model (APM) system. To encourage providers to join an APM, Congress provided for higher annual updates than participating in the traditional fee for service Medicare and MIPS. For a deeper dive on the composite scoring process, read my blog from last summer.

The physician community supported this, as it was expected to rewards providers for meeting these performance thresholds. We also were told that MIPS bonuses could be up the 3x the maximum cuts for that year. This meant that, depending on where a provider scored, bonuses could total 9 to 27%.

But as we’ve experienced: if it sounds too good to be true, it probably is.

Lesson Learned: The Promised Payment Updates Are a Mirage

MACRA has always been subject to budget neutrality: bonuses are proportional to cuts, and for that pool of bonus money to exist, cuts have to come first. The total amount paid out must equal the penalties assessed for budget neutrality that year.

Sound familiar? I discussed why the budget-neutrality system is broken in a previous post.

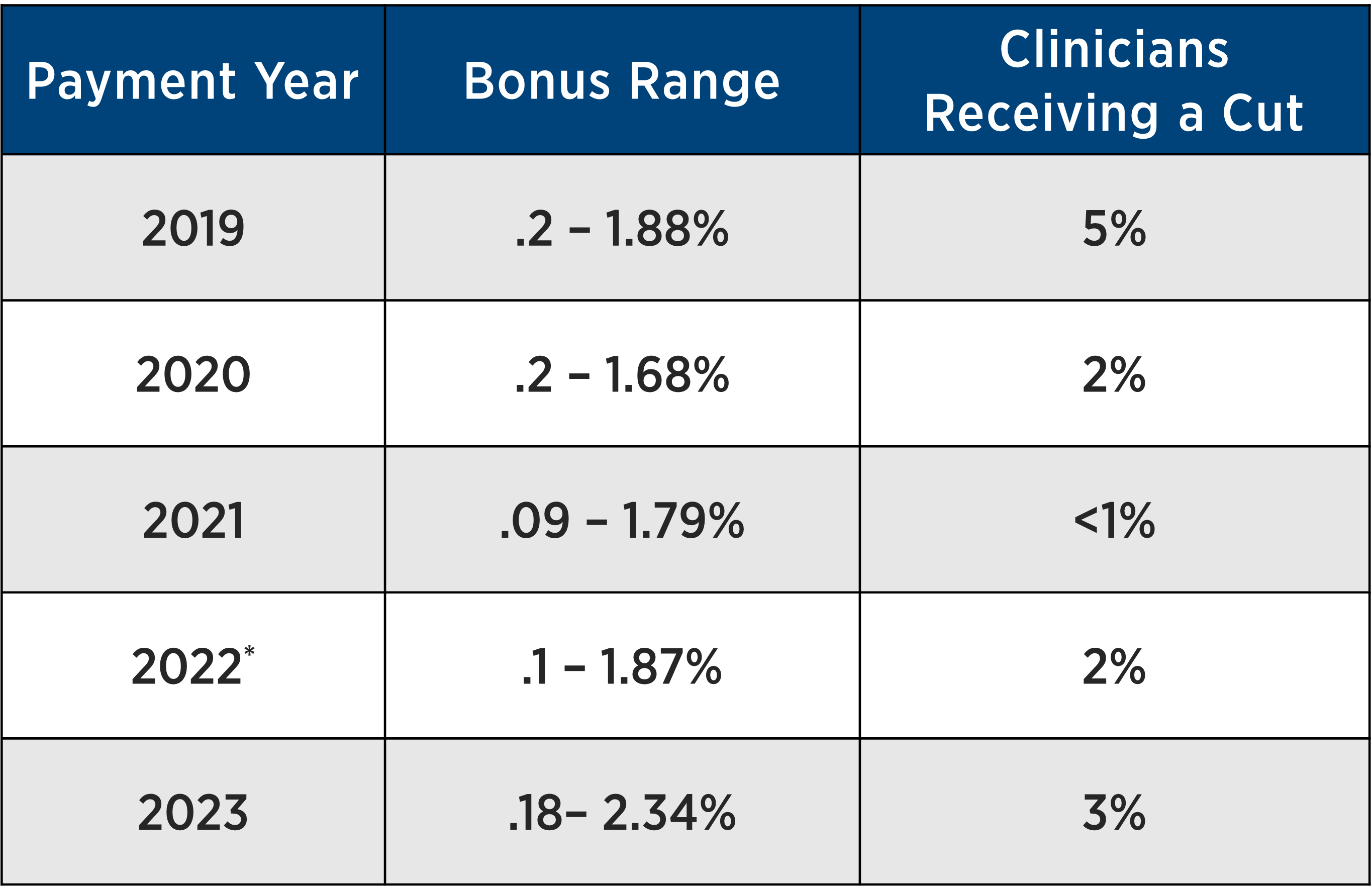

And what about these “bonuses” that were promised? Well, here is a summary sourced from CMS’ MIPS experience reports:

* CMS offered exceptions due to the COVID-19 pandemic later in performance year 2020

So, to recap, while the overwhelming majority of physicians did not receive a cut, the promised bonuses were quite meager – and the associated administrative burden meant there were some serious strings attached.

Also of note: MACRA is also not tied to the Medicare physician fee schedule conversion factor, a regulatory budget tool CMS uses to ensure that when there are changes in Medicare reimbursement/RVUs for certain services, it must be reallocated from all other services within the Medicare fee schedule. Read more about the Medicare conversion factor here.

In other words, more budget neutrality. Sound familiar?

For example, when Medicare decided to make changes to the evaluation & management services (E&M) and RVUs, all other services in the fee schedule were significantly impacted due to large proportion of dollars E&M services takes up in the fee schedule. CMS is proposing to add another E&M code (for complex patients), which CMS expects will be used by many specialties. Thus, we have a cut of more than 3% for all services in the Medicare fee schedule.

But wait, there’s more (cuts)!

That 3% number does not include cuts to Medicare providers overall, like those from the conversion factor and other congressional cuts (PAYGO and sequestration).

As I’ve written before, the budget-neutrality system is broken. Since MACRA was first implemented in 2017, the conversion factor has been cut over 5%. In fact, the Medicare conversion factor was higher in 1998 ($36.69) than it is in 2023 ($33.89), not to mention the proposed 2024 figure ($32.75).

Here’s the bottom line: Everyone and everything faces an unacceptable cut.

The Medicare physicians received 4% cut in 2023. When Congress passed the 2022 year-end omnibus package, they included a 2.5% increase to the Medicare reimbursement conversion factor in 2023 – yet the conversion factor was scheduled to cut physicians by 4.5%. What’s more, Congress took no action to waive an ongoing 2% Medicare sequester cut, which continued as planned into 2023. Congress did waive a projected 4% PAYGO cut for 2 years (2023 and 2024).

So that brings us to today. Including the proposed 2024 rates announced by CMS in July, combined with the above, physicians are now facing over 5% in cuts beginning in January 2024.

What else did we get? An unacceptable administrative burden.

Each year, CMS publishes administrative burden estimates for MIPS compliance. For 2024, CMS suggested roughly 38 hours of work per clinician were required, at a cost of nearly $7,800.

Does that estimate sound accurate to you? Of course not.

Beyond the lack of bonuses materializing, MIPS compliance has impacted our practices. Estimating compliance cost is notoriously difficult, but the available studies nevertheless suggest CMS’ figures are woefully low.

Congress is the only body with the power to rectify these issues in Medicare reimbursement, both for administrative burden and the cuts themselves. Instead of the annual routine of temporary reprieves, Congress must take action to fix our broken reimbursement system – now.